MARKET OVERVIEW

As of Close of 2nd Quarter 2024

S&P YTD – Equities performing well

2YR vs 30YR US Treasury yield

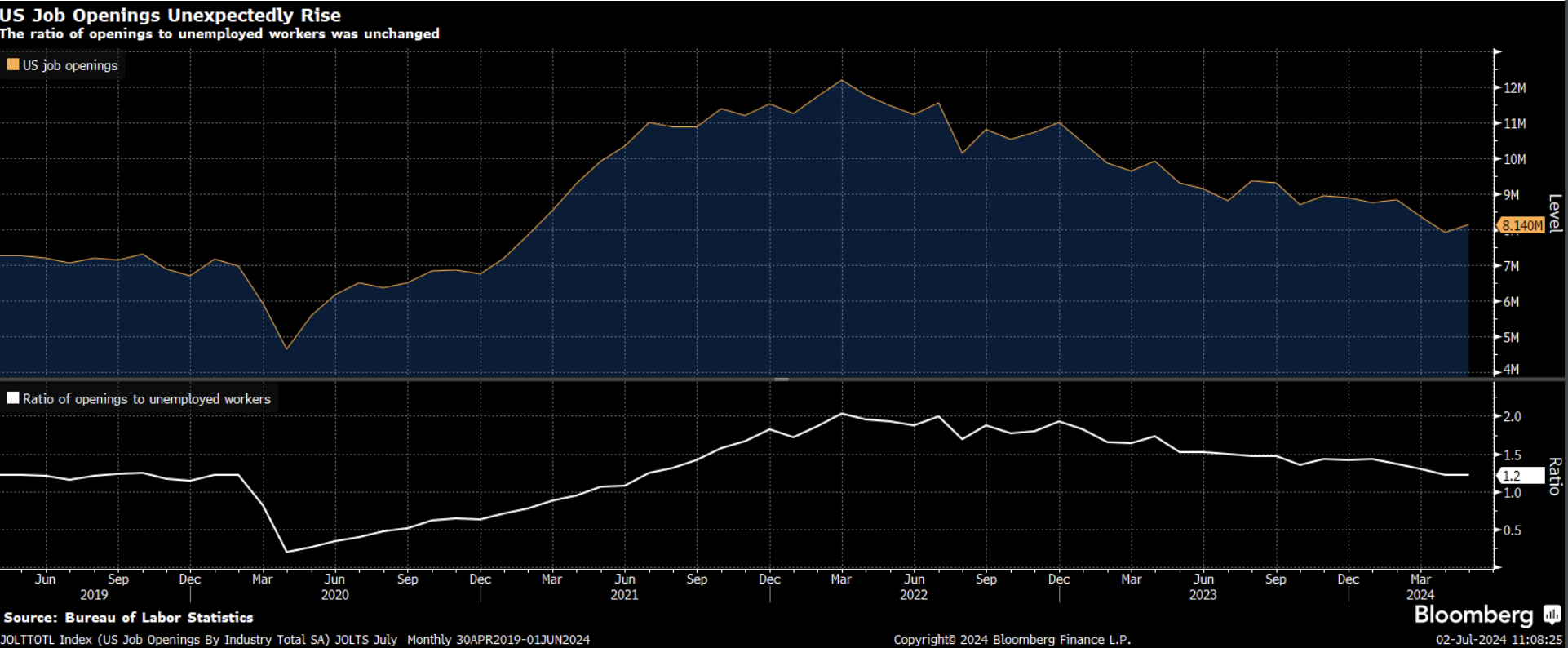

US Job Openings unexpectedly rise

Stocks and Profit Expectations at Record Highs

Market Recap

- US stocks rise and setting new record highs despite lower GDP data, slowing manufacturing data and a softer labor market.

Earnings expectations are elevated. - A sluggish housing market remains a concern. Softness in housing data – permits, starts, sales and prices all recently below

expectations. Inventories are ticking up in the both the new and existing homes. - Bond prices increased as yields dropped in the 2Q due to an increasing probability the Fed Reserve cutting interest rates later

this year. The market priced in expected in rate cuts. - The job market showing signs of cooling off, the openings (JOLT) fell to 3yr low in April to 8.1 million.

Market Outlook

- Earnings growth is expected to continue into next year at a modest pace. We are remaining a bullish outlook towards to US stocks.

- Interest rate cuts have been priced in the bond market, there is anticipation the Federal Reserve will cut rates by 25 basis points 1 or 2 times in the 3Q and 4Q.

- Housing market data could use a boost from rate cuts and summertime buying to reduce the excess of supply of homes. We expect the housing market to show signs of rebounding in the coming months into next year.

- We expect to see an increase in volatility for the 2nd half of 2024, with US elections, possible interest rate cuts and market expectations.